Quantitative risk premia analysis suggests quality and value factors may outperform in 2025, with Wolfe Research maintaining positive momentum outlook while Morgan Stanley expects momentum reversal after strong 2024 performance.

The S&P 500 projected to reach new highs in 2025, with major banks forecasting targets between 6,500-6,800, driven by earnings growth and AI-related investments, despite potential headwinds from policy changes.

Geographic dispersion in opportunities emerges, with U.S. large caps and Japanese equities favored by multiple firms, while European value stocks show potential amid rising rates environment.

This comprehensive report aggregates and analyzes global asset allocation outlooks for 2025 from leading buy-side and sell-side institutions, with a particular focus on capturing alpha through strategic factor positioning and regional allocation. By synthesizing perspectives from major financial institutions including BlackRock, Goldman Sachs, JP Morgan, and others, this analysis provides investors with actionable insights for portfolio construction across asset classes, factors, and geographic regions in an evolving market landscape.

We utilize several Large Language Models to summarize and synthesize 70 expert regional outlooks for the macroeconomy, regional cross-assets classes, and quantitative risk premia.

Google's new Gemini Advanced with Deep Research is particularly helpful in identifying and aggregating insights from top Wall Street Firms. It easily solves ChatGPT's Context Window limitations by processing and recalling content from ~100 reports.

In my next report, I will express the synthesized consensus and contrarian views in a Tactical Long/Short Portfolio of ETFs.

To see the full report with annotated citations to each report I analyzed, please download the PDF version at the end of this report.

Q4 2024 and Full Year 2024 Recap from Wolfe Research

Wolfe Research highlights the significant shift in market sentiment that occurred in Q4 2024, driven by the unexpected outcome of the U.S. presidential election and the Federal Reserve's more hawkish stance on monetary policy. The S&P 500 experienced a pullback in December, ending the year with a 1.8% decline, while the Nasdaq Composite fell by 3.4%. Despite the late-year volatility, both indexes posted double-digit gains for the full year 2024, with the S&P 500 rising by 20.5% and the Nasdaq by 23.7%.

Wolfe Research emphasizes the potential for increased volatility in 2025, given the uncertainty surrounding the new administration's policies and their impact on the economy and markets. They also highlight the potential for higher inflation, driven by strong consumer spending and potential policy changes.

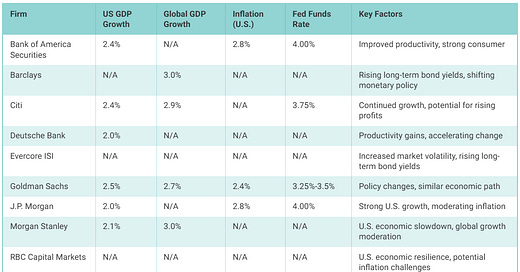

Macro Outlook

Key Insights:

While most firms anticipate continued economic growth in the U.S., there is a divergence of views on the pace of growth and the potential impact of policy changes.Goldman Sachs and J.P. Morgan project the highest U.S. GDP growth rates, while Vanguard and Morgan Stanley anticipate a more moderate pace.

Inflation remains a concern, with some firms expecting it to persist despite easing measures by central banks.

Wolfe Research emphasizes the potential for higher inflation in 2025, driven by strong consumer spending and potential policy changes.

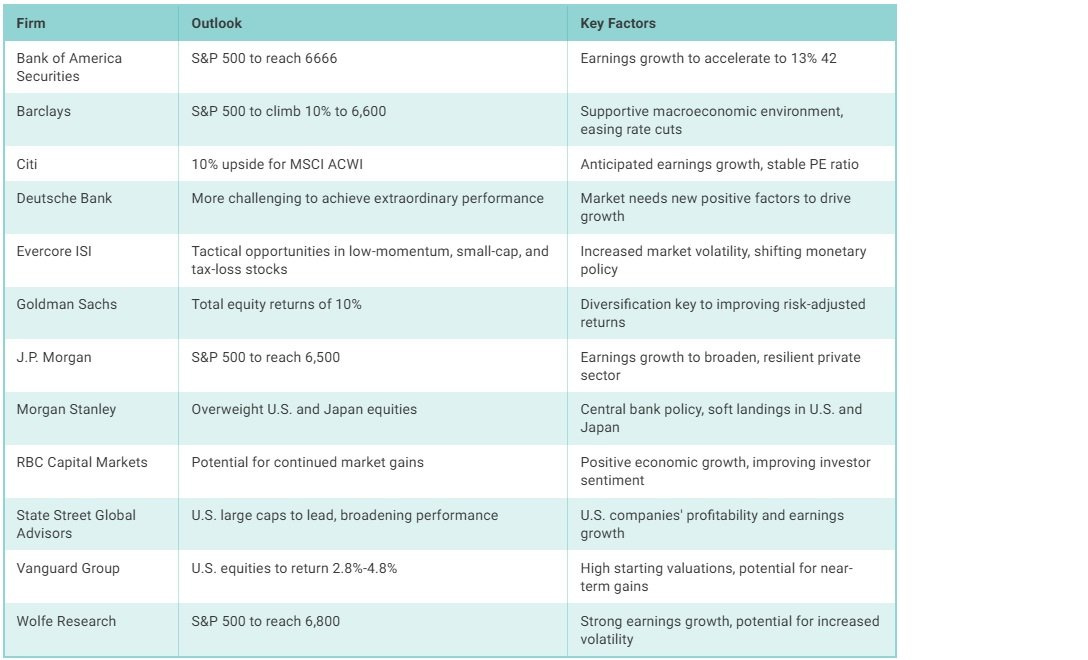

Equities Outlook

Key Insights:

Most firms maintain a positive outlook for equities, with expectations for continued market gains, albeit at a potentially slower pace.

There is a general consensus that U.S. equities will continue to perform well, driven by strong earnings growth and a resilient economy.

Diversification is highlighted as a key strategy to manage risk and enhance returns in a potentially volatile market environment.

Contrarian views, such as Deutsche Bank's cautious outlook and Evercore ISI's focus on tactical opportunities, provide a balanced perspective.

Wolfe Research's S&P 500 target of 6,800 is among the highest, reflecting their optimistic view on earnings growth.

Quant Risk Premia Outlook

Key Insights:

Some analysts believe that value stocks could outperform growth stocks as interest rates rise and economic growth slows. Others believe that growth stocks will continue to outperform, driven by strong earnings growth and continued investment in artificial intelligence.

Some analysts believe that growth stocks could continue to outperform, driven by the expanding era of innovation and the potential for higher corporate profits. Others believe that growth stocks are overvalued and could be vulnerable to a correction if interest rates rise or economic growth slows.

Some analysts believe that small-cap stocks could outperform as economic growth improves. Others believe that large-cap stocks will continue to outperform, driven by their strong fundamentals and lower risk.

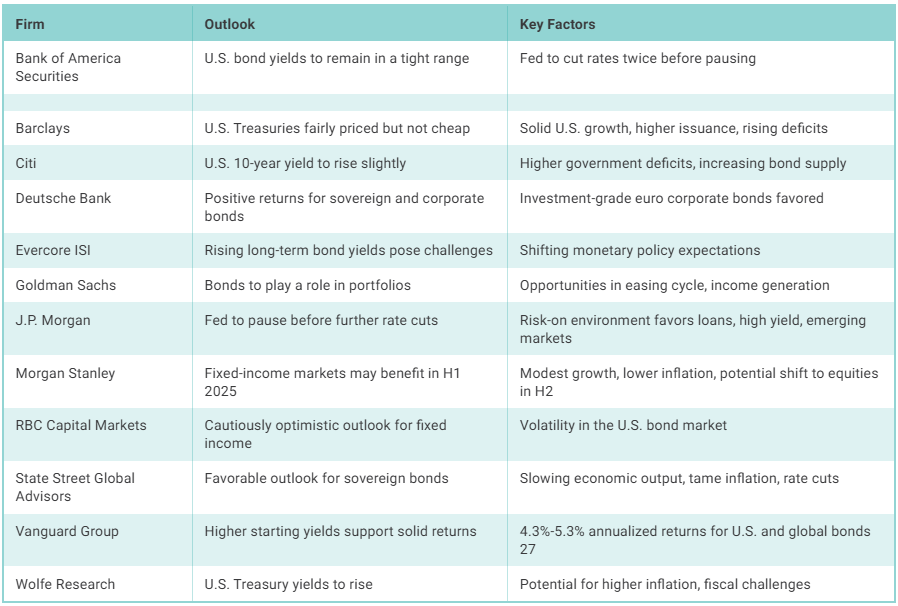

Bonds Outlook

Key Insights:

The outlook for bonds is generally positive, with expectations for continued rate cuts and attractive yields.

There is a divergence of views on the direction of U.S. Treasury yields, with some firms expecting them to rise while others anticipate a tight range.Active management and diversification are highlighted as key strategies to navigate potential volatility and enhance returns in the bond market.

Wolfe Research anticipates rising U.S. Treasury yields, driven by potential inflationary pressures and fiscal challenges.

Currencies Outlook

Key Insights:

Most firms anticipate a strong U.S. dollar in 2025, driven by the relative strength of the U.S. economy and potential policy changes.

There is some divergence of views on the extent of the dollar's strength and the potential for depreciation later in the year.Currency markets are expected to be volatile, with geopolitical risks and policy uncertainty contributing to potential fluctuations.

Specific currency pair outlooks include GBP strengthening against EUR and USD strengthening against CAD and CNY.

Wolfe Research expects the USD to remain strong, supported by the U.S. economic outperformance and the potential for higher interest rates.

Commodities Outlook

Key Insights:

The outlook for commodities is mixed, with expectations for softening oil prices and potential gains in metals.

Geopolitical risks and supply-demand dynamics are expected to be key drivers of commodity market performance.

Gold is viewed as a potential safe-haven asset amid uncertainty, with expectations for continued demand from central banks and investors.

Wolfe Research highlights gold as a top performer in the commodity space, citing its role as an inflation hedge and a safe-haven asset.

Referenced Research Reports

1. 2025 Investment Outlook | BlackRock Investment Institute, accessed January 7, 2025, https://www.blackrock.com/us/individual/insights/blackrock-investment-institute/outlook

2. BlackRock in the U.S. | About BlackRock, accessed January 7, 2025, https://www.blackrock.com/us/individual/about-us/about-blackrock

3. Events and Conferences - J.P. Morgan, accessed January 7, 2025, https://www.jpmorgan.com/about-us/events-conferences

4. JPMC Candidate Experience page Careers, accessed January 7, 2025, https://jpmc.fa.oraclecloud.com/hcmUI/CandidateExperience/en/sites/CX_1001

5. FOCUS 2024: Global asset allocation outlook live from Montreal – David Wolf, David Tulk & Ilan Kolet - YouTube, accessed January 7, 2025,

6. Mutual Funds - Fidelity Investments, accessed January 7, 2025, https://www.fidelity.com/mutual-funds/overview

7. Wharton Global Allocators Summit - Harris Family Alternative Investments Program - University of Pennsylvania, accessed January 7, 2025, https://altinvest.wharton.upenn.edu/globalallocatorsummit/

8. Asset Allocation and TAA Conferences - Savvy Investor, accessed January 7, 2025, https://www.savvyinvestor.net/investment-process/asset-allocation-and-taa/conferences

9. Visible Alpha Events - Financial Industry Events Around the Globe, accessed January 7, 2025, https://visiblealpha.com/events/

10. BofA Global Research: Award Winning Global Research & Data ..., accessed January 7, 2025, https://business.bofa.com/en-us/content/global-research-about.html

11. Bank of America & BofA Securities - Global Insights & Solutions, accessed January 7, 2025, https://business.bofa.com/content/boaml/en_us/home.html

12. Outlook 2025 | Barclays Private Bank, accessed January 7, 2025, https://privatebank.barclays.com/insights/2024/november/outlook-2025/

13. Home Page | Barclays, accessed January 7, 2025,

https://www.banking.barclaysus.com/

14. Citi | Global Investment Bank and Financial Services, accessed January 7, 2025, https://www.citigroup.com/global

15. Deutsche Bank USA, accessed January 7, 2025, https://country.db.com/usa/company/

16. Evercore, accessed January 7, 2025,

https://www.evercore.com/

17. Goldman Sachs: Home, accessed January 7, 2025,

https://www.goldmansachs.com/

18. About us | JPMorganChase, accessed January 7, 2025, https://www.jpmorganchase.com/about

19. Global Research & Strategy - Jefferies, accessed January 7, 2025, https://www.jefferies.com/our-services/global-research-strategy/

20. Investment Outlook 2025: Global Strategy | Morgan Stanley, accessed January 7, 2025, https://www.morganstanley.com/ideas/global-investment-strategy-outlook-2025

21. About Us | Morgan Stanley, accessed January 7, 2025, https://www.morganstanley.com/about-us

22. RBC Capital Markets | Home, accessed January 7, 2025,

https://www.rbccm.com/

23. accessed December 31, 1969, https://www.ubs.com/global/en/wealthmanagement/insights/

24. Wells Fargo Investment Institute Signals the U.S. is Positioned to Power the Global Economy in 2025, accessed January 7, 2025, https://newsroom.wf.com/English/news-releases/news-release-details/2024/Wells-Fargo-Investment-Institute-Signals-the-U.S.-is-Positioned-to-Power-the-Global-Economy-in-2025/default.aspx

25. Vanguard: Helping you reach your investing goals | Vanguard, accessed January 7, 2025,

https://investor.vanguard.com/

26. State Street Global Advisors - Wikipedia, accessed January 7, 2025, https://en.wikipedia.org/wiki/State_Street_Global_Advisors

27. Our economic and market outlook for 2025: Global summary - Vanguard, accessed January 7, 2025, https://corporate.vanguard.com/content/corporatesite/us/en/corp/articles/vanguard-economic-market-outlook-2025-global-summary.html

28. Vanguard Releases 2025 Economic and Market Outlook - PR Newswire, accessed January 10, 2025, https://www.prnewswire.com/news-releases/vanguard-releases-2025-economic-and-market-outlook-302328126.html

29. Vanguard Releases 2025 Economic and Market Outlook, accessed January 7, 2025, https://corporate.vanguard.com/content/corporatesite/us/en/corp/who-we-are/pressroom/press-release-vanguard-releases-2025-economic-and-market-outlook-121124.html

30. Weekly Market Recap | J.P. Morgan Asset Management, accessed January 7, 2025, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/weekly-market-recap/

31. Economic & Market Update - Asset Management - J.P. Morgan, accessed January 7, 2025, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/economic-and-market-update/

32. BofA Global Research Expects 2025 to be a Year of Further Equity Market Strength Amid Macro Uncertainty - Bank of America newsroom, accessed January 10, 2025, https://newsroom.bankofamerica.com/content/newsroom/press-releases/2024/12/bofa-global-research-expects-2025-to-be-a-year-of-further-equity.html

33. Global economy to see subdued growth amid geopolitical uncertainty in 2025: Barclays Bank - The Economic Times, accessed January 10, 2025, https://m.economictimes.com/news/international/business/global-economy-to-see-subdued-growth-amid-geopolitical-uncertainty-in-2025-barclays-bank/articleshow/115469220.cms

34. Market Outlook 2025 - Citi Wealth, accessed January 7, 2025, https://marketinsights.citi.com/wealthoutlook2025/index.html

35. 2025 Wealth Outlook: Growth amid discord: Strategies for a “rule-breaking” expansion - Citibank, accessed January 10, 2025, https://www.citibank.com.hk/global_docs/mobile/investment/pdf/invest_insight_e.pdf

36. US Outlook 2025: New Policies, Similar Path - Goldman Sachs, accessed January 10, 2025, https://www.goldmansachs.com/insights/goldman-sachs-research/2025-us-economic-outlook-new-policies-similar-path

37. A solid growth outlook for 2025 - Goldman Sachs, accessed January 10, 2025, https://www.goldmansachs.com/pdfs/insights/briefings/ASolidGrowthOutlookFor2025.pdf

38. Macro Outlook 2025: Tailwinds (Probably) Trump Tariffs | Goldman Sachs, accessed January 10, 2025, https://www.goldmansachs.com/insights/goldman-sachs-research/macro-outlook-2025--tailwinds--probably--trump-tariffs

39. Global Asset Allocation Views 1Q 2025 | J.P. Morgan Asset ..., accessed January 7, 2025, https://am.jpmorgan.com/us/en/asset-management/adv/insights/portfolio-insights/asset-class-views/asset-allocation/

40. Global Macroeconomic Outlook 2025 | Morgan Stanley, accessed January 10, 2025, https://www.morganstanley.com/ideas/global-macro-economy-outlook-2025

41. www.morganstanley.com, accessed January 10, 2025, https://www.morganstanley.com/ideas/global-macro-economy-outlook-2025#:~:text=The%20global%20economy%20should%20grow,and%20may%20vary%20across%20countries.

42. BofA Global Research Expects 2025 to be a Year of Further Equity Market Strength Amid Macro Uncertainty - PR Newswire, accessed January 10, 2025, https://www.prnewswire.com/news-releases/bofa-global-research-expects-2025-to-be-a-year-of-further-equity-market-strength-amid-macro-uncertainty-302320935.html

43. Barclays raises year-end 2025 S&P 500 price target to 6600 from 6500 - Investing.com, accessed January 10, 2025, https://www.investing.com/news/stock-market-news/barclays-raises-yearend-2025-sp-500-price-target-to-6600-from-6500-3738769

44. Citi's Manthey sees 10% upside potential for global stocks in 2025 By Investing.com, accessed January 10, 2025, https://www.investing.com/news/stock-market-news/citis-manthey-sees-10-upside-potential-for-global-stocks-in-2025-3806043

45. Deutsche Bank's outlook for 2025: both the economy and the market are unlikely to have any surprises. - Moomoo, accessed January 10, 2025, https://www.moomoo.com/news/post/46611620/deutsche-bank-s-outlook-for-2025-both-the-economy-and

46. Equity Outlook 2025: The Year of the Alpha Bet | Goldman Sachs, accessed January 10, 2025, https://www.goldmansachs.com/insights/goldman-sachs-research/2025-equity-outlook-the-year-of-the-alpha-bet

47. Global Equity Strategy 2025 Outlook The Year of the Alpha Bet - Goldman Sachs, accessed January 7, 2025, https://www.goldmansachs.com/pdfs/insights/goldman-sachs-research/2025-equity-outlook-the-year-of-the-alpha-bet/2025Outlook.pdf

48. Market Outlook 2025 | J.P. Morgan Research, accessed January 10, 2025, https://www.jpmorgan.com/insights/global-research/outlook/market-outlook

49. Global Insight 2025 Outlook | RBC Wealth Management, accessed January 10, 2025, https://www.rbcwealthmanagement.com/assets/wp-content/uploads/documents/insights/global-insight-2025-outlook.pdf

50. Equity Market Outlook 2025 - State Street Global Advisors, accessed January 10, 2025, https://www.ssga.com/us/en/institutional/insights/gmo-equity-outlook

51. Our investment and economic outlook, December 2024 - Vanguard Advisors, accessed January 7, 2025, https://advisors.vanguard.com/insights/article/series/market-perspectives

52. Q1 2025 Global Outlook: Room for optimism - Barclays Investment Bank, accessed January 7, 2025, https://www.ib.barclays/our-insights/3-point-perspective/q1-2025-global-outlook.html

53. Market outlook -December 2024 | DWS, accessed January 10, 2025, https://funds.dws.com/en-gb/inform/markets/market-outlook/market-and-macro/

54. Asset Management Outlook 2025: Landing on Bonds, accessed January 10, 2025, https://am.gs.com/en-us/advisors/insights/article/2024/asset-management-outlook-2025-landing-on-bonds

55. Global Fixed Income Views 1Q 2025 - J.P. Morgan Asset Management, accessed January 10, 2025, https://am.jpmorgan.com/us/en/asset-management/adv/insights/portfolio-insights/asset-class-views/fixed-income/

56. Capital Markets Outlook - New Year 2025 - RBC Global Asset Management, accessed January 10, 2025, https://www.rbcgam.com/en/ca/article/capital-markets-outlook-new-year-2025/detail

57. Fixed Income Outlook 2025 - State Street Global Advisors, accessed January 10, 2025, https://www.ssga.com/us/en/institutional/insights/gmo-fixed-income-outlook

58. Investment outlook for a changing market - Vanguard Advisors, accessed January 10, 2025, https://advisors.vanguard.com/strategies/investment-outlook

59. BofA sees stronger dollar in 2025, euro and franc to lag - Investing.com, accessed January 10, 2025, https://in.investing.com/news/forex-news/bofa-sees-stronger-dollar-in-2025-euro-and-franc-to-lag-93CH-4605967

60. PERSPECTIVES 2025 - Deutsche Bank Wealth Management, accessed January 10, 2025, https://www.deutschewealth.com/content/dam/deutschewealth/insights/investing-insights/economic-and-market-outlook/2025/PERSPECTIVES-Annual-Outlook-2025.pdf

61. Goldman Sachs picks top sectors to own in 2025 - TheStreet, accessed January 10, 2025, https://www.thestreet.com/investing/goldman-sachs-picks-top-sectors-to-own-in-2025

62. 2025 Global Fixed Income Outlook - Morgan Stanley, accessed January 10, 2025, https://www.morganstanley.com/im/en-us/individual-investor/insights/articles/2025-global-fixed-income-outlook.html

63. Currency Report Card: 2025 FX Outlook - Forecasts - RBC Capital Markets, accessed January 10, 2025, https://www.rbccm.com/assets/rbccm/docs/fx/currency-report-card.pdf

64. GBP vs USD: A Currency Showdown – Pound's Rise, Dollar's Dip | Central FX, accessed January 10, 2025, https://centralfx.co.uk/gbp-vs-usd-a-currency-showdown-pounds-rise-dollars-dip/

65. Barclays lowers its 2025 Brent price outlook to $83 per barrel, accessed January 10, 2025, https://www.hellenicshippingnews.com/barclays-lowers-its-2025-brent-price-outlook-to-83-per-barrel/

66. Annual outlook 2025: Deeply invested in growth - Deutsche Bank Wealth Management, accessed January 7, 2025, https://www.deutschewealth.com/en/insights/investing-insights/economic-and-market-outlook/cio-annual-outlook-2025-deeply-invested-in-growth.html

67. Goldman Sachs sees gold at $3150 per ounce, oil at $100 a barrel in 2025, accessed January 10, 2025, https://www.business-standard.com/markets/news/goldman-sachs-sees-gold-at-3-150-per-ounce-oil-at-100-a-barrel-in-2025-124112700549_1.html

68. Gold expected to see "moderate gains" in 2025 - RBC Capital Markets By Investing.com, accessed January 10, 2025, https://www.investing.com/news/commodities-news/gold-expected-to-see-moderate-gains-in-2025--rbc-capital-markets-3800228

69. Global Asset Allocation Views 1Q 2025 - Asset Management - J.P. Morgan, accessed January 7, 2025, https://am.jpmorgan.com/us/en/asset-management/institutional/insights/portfolio-insights/asset-class-views/asset-allocation/

70. Quarterly Market Perspective: Four Quarter 2024 - Fidelity Investments, accessed January 7, 2025, https://www.fidelity.com/learning-center/wealth-management-insights/quarterly-market-perspective

Large Language ModelWall Street EstimatesQuantamental ResearchQuantitative Research