2025 High Conviction Short: Microchip Technology Inc. (MCHP)

Disclaimer - You Missed the Chance to receive the idea that is NOT investment advice!

The following Note was posted on Smartkarma, an Independent Investment Research Aggregation platform primarily specializing in the Asia-Pacific region. Originally it was published as a High Conviction Short idea for 2025. Shortly after publication on 12/2/24, the thesis started rapidly paying off. The short target price to close the trade is nearly met.

Join Smartkarma to get these ideas when published. Use the following Promotional Link and code (SKPRO10) to get 10% off the annual subscription fee.

EXECUTIVE SUMMARY

Initiate a Short Position in MCHP Target Price Range: $45-50 Time Horizon: 6-12 months

Declining fundamentals: Q2 FY2025 revenue declined 48% YoY, with adjusted EPS falling 72% YoY. Valuation concerns: P/E of 36.8x vs. sector median of 22x, unsupported by current performance.

Geo-Political risk: 50% of sales from Asia, exposed to potential trade tensions. Operational challenges: Customer destocking and sluggish demand. ETF-Driven price support: Potential for sharp correction if sector rotation occurs.

Date: November 24, 2024

Recommendation: Initiate a short position in Microchip Technology Inc. (NASDAQ: MCHP)

Current Price: $66.69

Target Price Range: $45-50

Time Horizon: 6-12 months

Position Sizing: Moderate with staged entry

Microchip Technology's declining fundamentals and geopolitical vulnerabilities offer an attractive short opportunity. Elevated valuations, unsustainable ETF-driven pricing, cyclical pressures and overreliance on Asia-Pacific sales amidst potential geopolitical risks present significant downside potential. However, prudent position sizing and hedging strategies are essential to mitigate risks of a potential sector recovery or geopolitical stabilization.

1) Financial Performance

Q2 FY2025 revenue: $1.16B (-48% YoY, -6.2% QoQ)

Adjusted EPS: $0.46 vs. $0.43 estimate (-72% YoY)

Gross margin: 59.5% vs. 68.1% YoY

Operating margin: 29.3%

Factors impacting profitability:

$25.9M capacity underutilization charges

$21.4M cybersecurity incident costs

Manufacturing inefficiencies due to lower volumes

2) End Market Exposure

Industrial (43% of revenue): Significant inventory correction ongoing

Data Center & Computing (18%): AI-driven segment showing strength

Automotive (18%): Experiencing cyclical downturn, particularly in Europe

3) Geographical Risk

Asia: 50% of revenue

Americas: 32%

Europe: 18%

Europe showing particular weakness (-22% sequential decline), while Greater China described as "least weak" among regions. Its substantial exposure to retaliatory measures against U.S.-China tariffs and macroeconomic headwinds amplifies downside risks.

4) Strategic Initiatives

CHIPS Act negotiations advancing

FY2025 capex guidance: $150M, with further reduction expected in FY2026

Continued R&D investment despite downturn

Focus on Total System Solutions (TSS) strategy

5) Management Outlook

Q3 FY2025 revenue guidance: $1.025-1.095B

Gross margin guidance: 57-59%

Sluggish bookings and inventory destocking signal limited visibility into future recovery.

6) Risk Factors

Short-term:

Continued revenue decline

Margin pressure

Market/external factors (trade tensions, semiconductor cycle)

Long-term:

Competitive position

Strategic execution

Capital structure sustainability

7) MCHP vs. Peers, SEMI Index and NASDAQ

Key Metrics Comparison

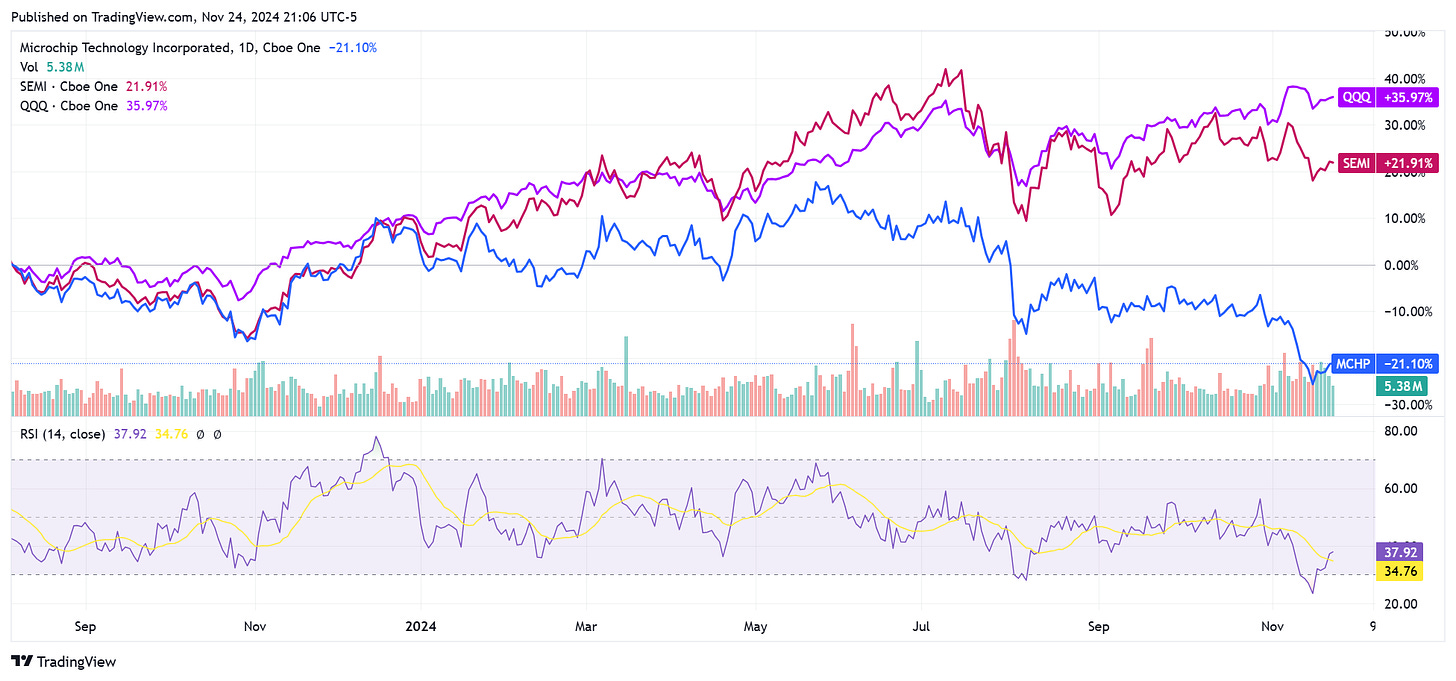

Price Momentum vs. Semi & Broader Technology Sector

MCHP (blue line) shows a clear downward trend, especially since July 2024.

SEMI Index (red line) and NASDAQ (purple line) have outperformed MCHP, particularly in recent months.

The divergence between MCHP and the broader indices has widened. MCHP's underperformance suggests a loss of investor confidence not reflected in the broader semiconductor sector or tech market.

Decoupling from ETF support: As MCHP continues to lag behind the SEMI Index, it may become less attractive for inclusion in sector ETFs, potentially reducing the artificial price support it has received.

Potential for further decline: If MCHP continues to break away from the ETF-driven support, it may experience a more significant correction to align with its fundamentals and peer valuations.

8) Risks to the Short Thesis

Semiconductor Recovery: A broader sector recovery could lift MCHP regardless of company-specific issues.

Geopolitical Stability: De-escalation in trade tensions could mitigate Asia-Pacific risks.

Technological Advances: Success in emerging technologies (e.g., AI, 5G) could reverse investor sentiment.

Risk of a Short Squeeze: MCHP's elevated short interest (5.64%) and days to cover (6.34), combined with its higher beta, suggest a heightened risk of a short squeeze compared to industry peers.

Utilize hedging strategies, such as options, to protect against adverse price movements.

Given these factors, caution is advised when considering short positions in MCHP, especially for smaller investors.

9) Trade Implementation Strategy

Position Management

Initial Entry: 25%-33% of planned allocation, adjusting based on geopolitical developments and ETF flow trends.

Stop Loss: $100 to limit losses.

Hedging

Employ put spreads to manage downside risk

Exit Triggers

Evidence of semiconductor market recovery.

Improved operational performance or successful CHIPS Act implementation.

Target Price Range: $45-50

Time Horizon: 6-12 months

Conclusion

In conclusion, the combination of weakening fundamentals, geographic risks, and technical underperformance presents a compelling case for initiating a short position in MCHP, with a target price range of $45-50 over the next 6-12 months.

Join Smartkarma to can get these ideas when published. Use the following Promotional Link and code (SKPRO10) to get 10% off the annual subscription fee.