Making Sense of the Macro: Systematic Investing in an Era of Uncertainty

How quantitative frameworks and adaptive strategies help investors navigate yield curve shifts, geopolitical tensions, and market volatility

Editor's Note: This research was conducted and initially published prior to the recent escalation between Israel and Iran. While the core systematic frameworks and empirical findings remain valid, current geopolitical developments underscore the importance of adaptive macro investing approaches discussed herein. The accompanying Google Colab notebook referenced in this paper allows readers to update assumptions and re-run sector sensitivity models with real-time data to assess how ongoing events may be affecting macro-sector relationships.

Introduction: Understanding Macro for Smarter Investing

In today's volatile economic landscape, traditional investing instincts often fall short. Interest rates shift unexpectedly, inflation persists in waves, geopolitical tensions complicate global markets, and now we're witnessing renewed Middle East conflicts that ripple through energy and financial markets. For investors seeking clarity, the challenge is no longer just what to invest in, but how to make sense of the macro signals shaping those decisions.

That's why I wrote "Navigating the New Macro Landscape: Systematic Approaches to Alpha Generation in an Era of Geopolitical Uncertainty". The paper offers a comprehensive review of macroeconomic modeling and quantitative investing frameworks. Whether you're building a personal portfolio or refining a professional strategy, this research is designed to support investors who want to make smarter, more adaptive decisions in uncertain times.

This post outlines the key ideas, methods, and implications from the paper, and how they can be applied in practice—especially as markets navigate both monetary policy shifts and geopolitical developments.

1. Why Macroeconomics Matters for Modern Investors

Macroeconomic variables, such as inflation, interest rates, GDP growth, and currency strength, are not background noise. They are active drivers of asset prices. And while these factors are widely tracked, their nuanced effects on specific sectors and asset classes are often overlooked.

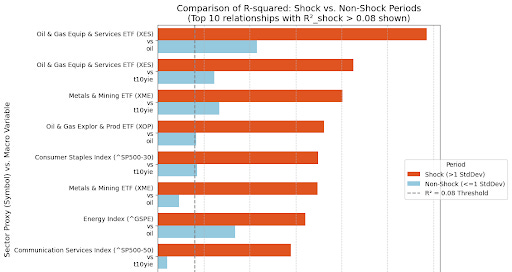

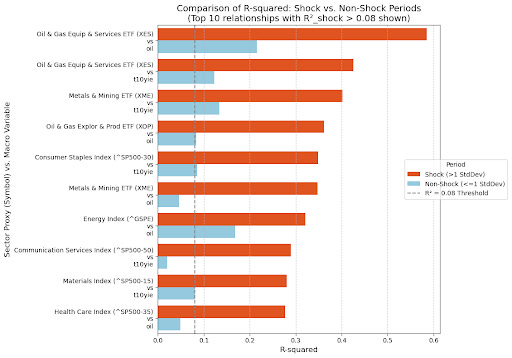

The paper's findings show that:

Financials tend to benefit from a steepening yield curve

Energy and Materials respond positively to inflation and global growth signals

Utilities and Real Estate typically struggle when long-term rates rise

Understanding these patterns helps investors move from passive exposure to informed positioning, rotating between sectors or assets based on their macro sensitivity. Recent geopolitical events add another layer—energy security concerns can amplify these relationships or create new cross-currents that require careful analysis.

2. Systematic Macro: From Theory to Tactical Allocation

One of the most practical outcomes of this research is how macroeconomic data can be used in systematic asset allocation.

In Q2 2025, for example, we are observing a rare "Twist Steepening" of the U.S. yield curve, where long-term interest rates are rising while short-term rates decline. Combined with current geopolitical tensions, the research suggests:

Overweighting cyclical sectors (e.g., Industrials, Financials)

Underweighting rate-sensitive areas (e.g., Utilities, REITs)

Taking a barbell approach within growth sectors (e.g., pairing AI infrastructure with lower-duration tech)

Considering energy security implications for Materials and Energy allocations

These portfolio adjustments aren't guesswork—they're based on empirical relationships replicated across economic regimes and stress-tested through various geopolitical scenarios.

3. Enhancing Alpha with Factor Investing and Machine Learning

Beyond macro signals, the research explores how style factors (such as value, momentum, and profitability) behave under different economic conditions. For instance:

Momentum and profitability tend to outperform during inflationary periods

Value shows mixed performance—outperforming when tied to sectors like Financials, but vulnerable when exposed to long-duration equities

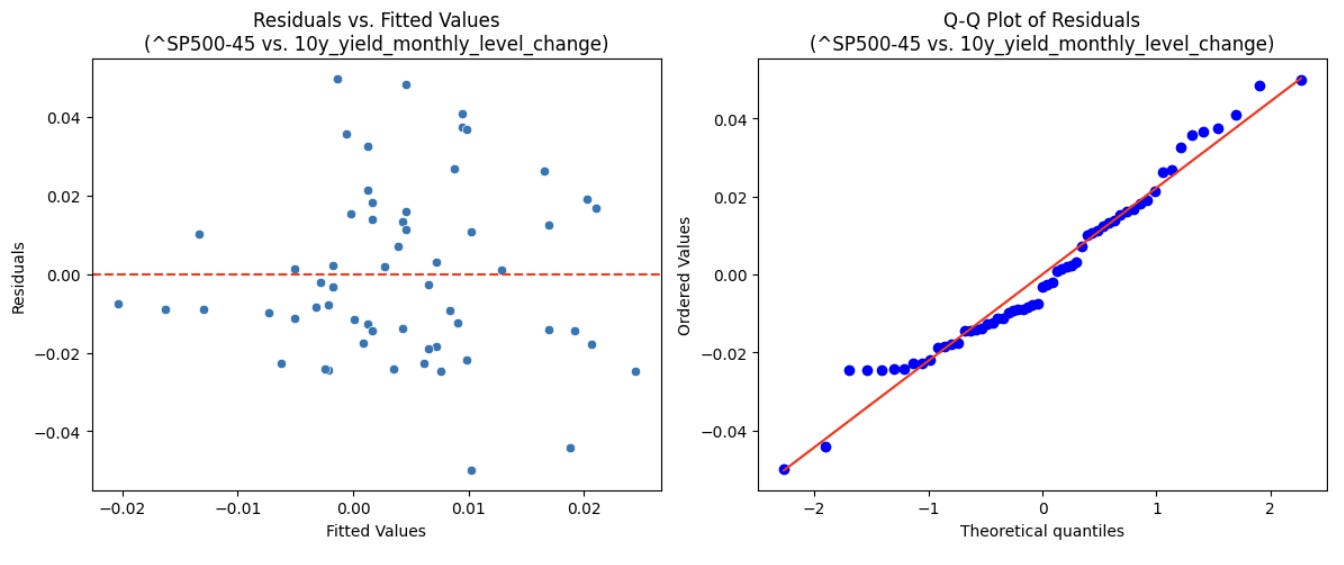

Incorporating machine learning into these strategies allows for:

Identification of non-linear relationships often missed by traditional models

More accurate regime classification based on real-time data

Dynamic weighting of macro signals based on their predictive strength

This fusion of macroeconomics and machine learning enables strategies that evolve with the market, rather than reacting after the fact.

4. Systematic ≠ Robotic: The Role of Human Judgment

While systematic investing is built on rules, it does not mean removing human insight—particularly during periods of heightened geopolitical risk. Recent events in the Middle East exemplify why hybrid approaches, which combine data-driven models with discretionary oversight, offer the best of both worlds.

During geopolitical crises, human judgment becomes especially critical because:

Regime Identification: Models trained on historical data may not immediately recognize new geopolitical regimes. For instance, escalating Middle East tensions could trigger a distinct risk-off environment that differs from typical monetary policy-driven cycles.

Alternative Data Integration: Geopolitical events generate signals that traditional macro models might miss—satellite data showing supply chain disruptions, sentiment analysis of diplomatic communications, or real-time commodity flow tracking. Human analysts can quickly incorporate these alternative data sources while systematic models adapt.

Dynamic Risk Assessment: While our research shows Energy sectors typically benefit from oil price volatility and Utilities underperform during rate rises, geopolitical events can create complex cross-currents. Human oversight helps navigate situations where, for example, defensive sectors might outperform despite rising rates due to flight-to-quality dynamics.

Examples of this hybrid approach include:

Using models to surface macro-sensitive sectors, then applying judgment to assess evolving geopolitical risks

Letting machine learning identify predictive signals, then deciding which exposures remain contextually relevant amid changing global dynamics

Employing the systematic framework's sector sensitivity insights while overlaying discretionary hedges for tail risk scenarios

Practical Application: The Google Colab notebook accompanying this research can be re-run with updated data to capture how recent geopolitical developments are affecting the empirical relationships we've identified. This real-time adaptability exemplifies how systematic approaches should evolve with changing conditions rather than remaining static.

Especially in periods like the current Twist Steepening combined with Middle East tensions, human context helps interpret what models can't yet quantify—such as the duration and spillover effects of regional conflicts on global supply chains and energy markets.

5. Risk Management: Tailoring Portfolios to Changing Regimes

Systematic macro investing is not just about opportunity—it's also about protection. The paper lays out frameworks for managing risk through:

Diversification across asset classes and geographies

Tactical shifts based on sector sensitivities

Derivative overlays to hedge inflation or interest rate volatility

Geopolitical risk hedging through energy exposure or safe-haven positioning

By analyzing historical performance across different yield curve regimes, the research also illustrates how risk and return profiles shift over time. For example, Utilities may offer stability during flat or inverted curves but underperform when long-term yields rise. Current geopolitical tensions add another dimension, where traditional defensive sectors might behave differently due to supply chain vulnerabilities or energy security concerns.

6. Key Takeaways for the Modern Investor

This research was written for investors who want to approach markets with structure, insight, and confidence. Whether managing a 401(k), an institutional portfolio, or a side brokerage account, the following principles apply:

✅ Macro matters—sector performance is not random

✅ Systematic thinking enhances clarity and reduces emotional bias

✅ Data and models are tools—human judgment remains essential

✅ Adaptive frameworks are better than fixed forecasts

✅ Advanced techniques like machine learning offer real, practical benefits

✅ Geopolitical awareness enhances systematic frameworks—while models provide structure, human judgment remains essential for interpreting unprecedented events and updating assumptions in real-time

Explore More

To access the full research paper, interactive visualizations, and code notebooks for replicating sector sensitivity models:

📄 Full Paper: Navigating the New Macro Landscape: Systematic Approaches to Alpha Generation in an Era of Geopolitical Uncertainty - SSRN

🔬 Interactive Analysis: Google Colab notebook (freely accessible) - allows you to update assumptions and re-run sector sensitivity models with current data to assess how ongoing geopolitical events may be affecting macro-sector relationships

🌐 Additional Resources: www.HarmoniQInsights.com

Note: The Google Colab notebook is particularly valuable for practitioners who want to test how recent Middle East developments or other geopolitical events are impacting the empirical relationships identified in our research.

About the Author

William Mann is the founder of HarmoniQ Insights and the author of numerous research papers. He specializes in quantitative research at the intersection of macroeconomics and investing. His mission is to simplify complexity and empower investors with actionable insights, regardless of background or experience level.

If you found this analysis helpful, please share it with others who might benefit. And don't forget to subscribe for more insights on navigating today's complex investment landscape.